Income Tax Bill 2025: Comprehensive Analysis of Key Changes from Income Tax Act 1961

The Income Tax Bill 2025, passed by the Lok Sabha on August 11, 2025, represents the most significant overhaul of India’s income tax legislation since independence. This comprehensive legislation consolidates and modernizes the existing Income Tax Act 1961, introducing substantial structural, procedural, and substantive changes that will reshape the tax landscape for individuals, businesses, and institutions across India.

Structural and Organizational Transformation

Legislative Framework Overhaul

The Income Tax Bill 2025 introduces a completely restructured legislative framework with 536 sections organized across 23 chapters, compared to the current Income Tax Act 1961. This represents a fundamental reorganization of the tax code, designed to enhance clarity, reduce ambiguity, and improve ease of compliance. The new structure follows a more logical progression, starting with preliminary provisions, moving through the basis of charge, income computation, and concluding with enforcement and miscellaneous provisions.

The bill consolidates various amendments and circulars that have been issued over the decades into a single, cohesive document. This consolidation aims to eliminate the complexity that has accumulated through numerous amendments to the 1961 Act, providing taxpayers and professionals with a clearer understanding of their obligations and rights under the law.

Enhanced Definitional Framework

One of the most significant changes is the introduction of over 110 detailed definitions in Section 2, compared to the more limited definitional scope in the current Act. These definitions include contemporary concepts such as “virtual digital asset,” “business trust,” “significant economic presence,” and “place of effective management”. The expanded definitional framework addresses modern business realities and digital economy transactions that were not envisioned when the 1961 Act was enacted.

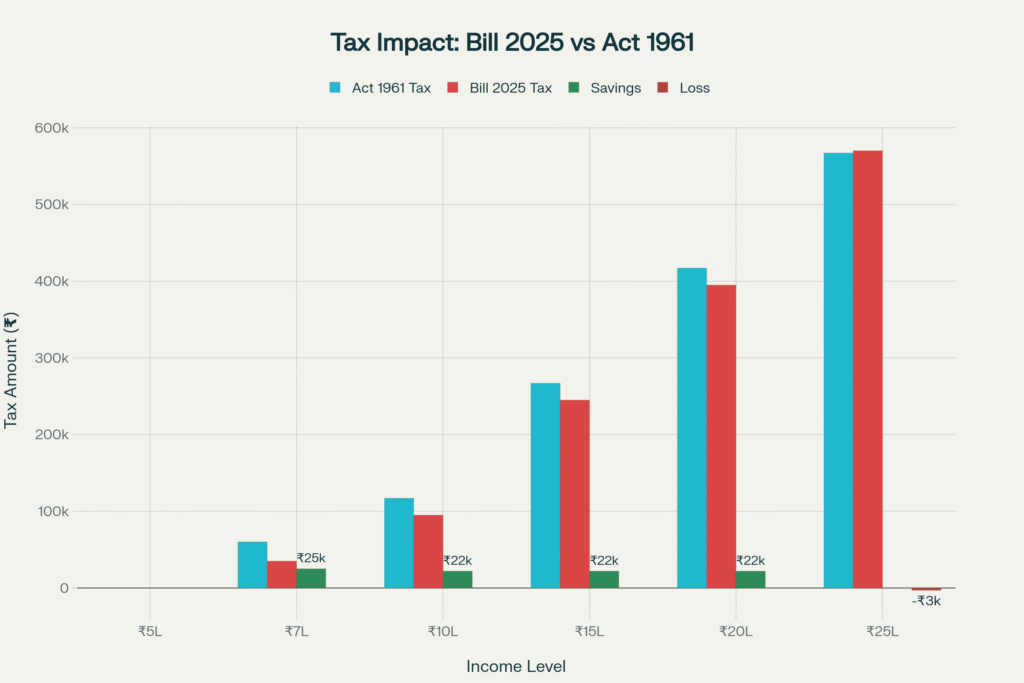

Tax Impact Analysis: Income Tax Savings Under New Bill 2025

Key Substantive Changes and Innovations

Digital Economy and Virtual Assets

The Income Tax Bill 2025 introduces comprehensive provisions for taxing the digital economy, including detailed definitions and tax treatment of virtual digital assets. Section 2(111) defines virtual digital assets to include any information, code, number, or token generated through cryptographic means, non-fungible tokens, and other digital assets as may be specified by the Central Government. This represents a significant advancement over the current Act, which has struggled to address cryptocurrency and digital asset transactions effectively.

The bill also introduces the concept of “significant economic presence” in Section 9(9)(d), which allows India to tax non-resident entities based on their digital footprint in the country, even without a physical presence. This provision addresses the challenges posed by multinational digital companies that generate substantial revenues from Indian users without maintaining traditional business establishments in India.

Modernized Residence and Source Rules

The bill substantially revises the residence determination criteria in Section 6, introducing more nuanced rules for determining tax residency. Notable changes include the introduction of provisions for individuals with income exceeding fifteen lakh rupees from sources other than foreign sources, and refined criteria for determining “not ordinarily resident” status. These changes aim to prevent tax avoidance while providing clarity for legitimate taxpayers.

The concept of “place of effective management” for companies has been incorporated directly into the residence definition, providing greater certainty for corporate taxpayers regarding their tax obligations. This represents a shift from the current Act’s more ambiguous residence determination criteria.

Administrative and Procedural Enhancements

Faceless Assessment and Digital Procedures

The Income Tax Bill 2025 formalizes the concept of faceless assessment and collection procedures, incorporating lessons learned from the digital transformation of tax administration during recent years. Section 245 provides for faceless jurisdiction of income-tax authorities, while Section 273 specifically addresses faceless assessment procedures. These provisions aim to reduce taxpayer harassment, eliminate corruption, and improve the efficiency of tax administration.

The bill also introduces enhanced provisions for digital document management, electronic hearings, and online compliance procedures. Section 2(48) defines “hearing” to include communication of data and documents through electronic mode, reflecting the permanent shift toward digital tax administration.

Strengthened Anti-Avoidance Measures

The bill incorporates and enhances existing anti-avoidance provisions, including transfer pricing rules, general anti-avoidance rules (GAAR), and specific anti-avoidance measures. Chapter X (Sections 161-177) provides comprehensive transfer pricing provisions, while Chapter XI (Sections 178-184) details the General Anti-Avoidance Rule framework. These provisions have been streamlined and clarified compared to their counterparts in the current Act.

The bill also introduces enhanced provisions for combating aggressive tax planning, including stricter limitations on interest deductions in certain cases (Section 177) and special measures for transactions with persons located in notified jurisdictional areas (Section 176).

Tax Rate Structure and Regime Changes

New Tax Regime Framework

The Income Tax Bill 2025 formalizes and expands the new tax regime options that were introduced through recent amendments to the current Act. Chapter XIII-C (Sections 199-205) provides detailed provisions for the new tax regime for individuals, Hindu undivided families, and others, as well as special tax rates for certain domestic companies and cooperative societies. This represents a significant simplification of the tax structure, offering taxpayers clearer choices between different tax regimes.

The bill also introduces specific provisions for new manufacturing domestic companies and cooperative societies, providing incentive structures to promote manufacturing and cooperative sector development. These provisions demonstrate the government’s commitment to using the tax system as a tool for economic development and sectoral growth.

Enhanced Deduction and Exemption Framework

While the new tax regime offers lower rates with fewer deductions, the bill maintains and in some cases enhances the deduction framework under Chapter VIII (Sections 122-154). New deductions have been introduced for specific purposes such as contributions to the Agnipath Scheme (Section 125) and purchase of electric vehicles (Section 132). These targeted deductions reflect contemporary policy priorities including defense modernization and environmental protection.

Compliance and Penalty Reforms

Rationalized Penalty Structure

The Income Tax Bill 2025 introduces a more rationalized penalty structure in Chapter XXI (Sections 439-472), aimed at reducing litigation while maintaining deterrent effects. The penalty provisions have been streamlined to provide greater clarity regarding the circumstances under which penalties may be imposed and the quantum of such penalties. This represents a significant improvement over the current Act’s sometimes overlapping and confusing penalty provisions.

The bill also introduces provisions for penalty reduction and waiver in certain circumstances (Section 469), providing tax authorities with greater flexibility to address genuine hardship cases while maintaining compliance standards.

Enhanced Dispute Resolution Mechanisms

Chapter XVIII of the bill (Sections 356-389) provides comprehensive provisions for appeals, revision, and alternative dispute resolution mechanisms. The bill introduces enhanced dispute resolution committee procedures and streamlines the appeal process to reduce the burden on both taxpayers and tax authorities. These procedural improvements aim to reduce the time and cost associated with tax disputes while ensuring fair resolution of disagreements.

Sectoral and Special Provisions

Non-Profit Organization Framework

The Income Tax Bill 2025 introduces a completely revamped framework for taxation of non-profit organizations in Chapter XVII-B (Sections 332-355). This new framework replaces the existing provisions for charitable organizations with a more comprehensive and structured approach. The new provisions include detailed registration procedures, compliance requirements, and taxation rules for registered non-profit organizations.

The bill introduces concepts such as “regular income,” “specified income,” and “corpus donation” with clear definitions and tax treatment, providing greater certainty for non-profit organizations regarding their tax obligations. This represents a significant improvement over the current Act’s sometimes ambiguous provisions for charitable organizations.

International Financial Services Centre Provisions

Recognizing India’s growing importance as a financial hub, the bill includes enhanced provisions for International Financial Services Centres (IFSCs). These provisions provide special tax treatment for various activities conducted in IFSCs, including provisions for offshore banking units and investment funds. This demonstrates the government’s commitment to developing India as a global financial center.

Implementation and Transition Considerations

Effective Date and Transitional Provisions

The Income Tax Bill 2025 is scheduled to come into force on April 1, 2026, providing taxpayers and tax professionals with adequate time to familiarize themselves with the new provisions and prepare for implementation. The bill includes comprehensive repeal and savings provisions (Section 536) to ensure smooth transition from the current Act to the new legislation.

The transitional provisions are designed to protect existing rights and obligations while providing clarity regarding the application of new provisions to ongoing transactions and assessments. This careful approach to implementation reflects the government’s recognition of the significant impact that such comprehensive tax reform will have on all stakeholders.

Conclusion

The Income Tax Bill 2025 represents a landmark achievement in Indian tax legislation, providing a modern, comprehensive, and digitally-enabled framework for income taxation. The bill addresses contemporary challenges while maintaining the fundamental principles of equity and efficiency that have guided Indian tax policy. Key benefits include enhanced clarity through improved organization and definitions, comprehensive coverage of digital economy transactions, streamlined administrative procedures, and stronger anti-avoidance measures.

The successful implementation of this legislation will require coordinated efforts from tax authorities, taxpayers, and tax professionals to ensure smooth transition and effective compliance. The government’s commitment to providing adequate lead time and comprehensive guidance during the transition period will be crucial for the success of this ambitious reform initiative.